As we integrate digital technologies into every aspect of our lives it can be hard to make informed choices about the privacy and security risks that come with them. For example, users probably know they should be concerned about security risks when choosing a payment app, but it can be difficult to understand what those risks might be.

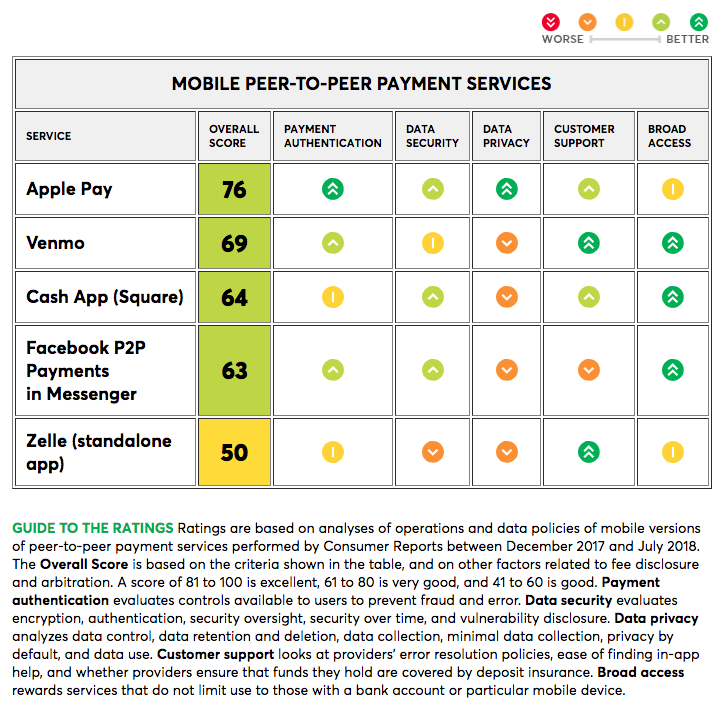

For the first time, Consumer Reports has an answer. They have developed The Digital Standard, a new set of criteria and tests for digital technologies and applied it peer-to-peer payment (P2P) apps (like Apple Pay and Venmo) to evaluate, as CR puts it, “how well the services authenticate payments to prevent fraud and error, secure user data, and protect privacy.”

This is a major development from an organization that has a long history of testing products, making data available to the public, and bringing about major changes to product safety, from demonstrating the flaws in bad seatbelt design to emphasizing the dangers of cigarettes. What impact might these new ratings have on digital technology beyond P2P payment apps?

The skills and expertise required for an undertaking like this is substantial, and Consumer Reports isn’t doing this alone. They have partnered with other Ford grantees, including Ranking Digital Rights and the Cyber Independent Testing Lab, to build out robust, objective tests that examine the privacy and security properties of digital goods. This is the culmination of years of work and is the foundation for a future where the digital technologies we use every day respect our privacy and security needs.

You can read more about this landmark moment on Consumer Reports.

Top image courtesy of Consumer Reports